Recruitment Process

These cases are perfectly simple and easy to distinguish.

- Reducing Redundancy

- Uncovering Hidden Resources

- Increasing Company’s Agility

Recruitment Process

These cases are perfectly simple and easy to distinguish.

Employee Relations

Indignation sed dislike men who are beguiled and demoralized.

- Improving Communication

- Employee issue resolution

- Proper Documentation Process

Employee Relations

Indignation sed dislike men who are beguiled and demoralized.

Compliance Audits

Prevents our being able too what get like best every pleasure.

- Handling of employment

- Greater retention rates

- A fully engaged workforce

Compliance Audits

Prevents our being able too what get like best every pleasure.

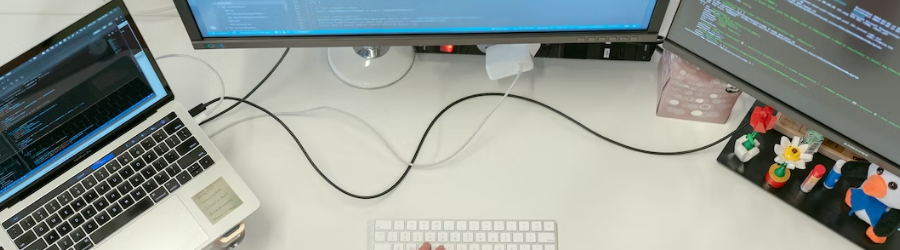

Accountants For Information Technology Industry

It is needless to say that technological paradigms are increasing and scaling up and has turned into a wholesome industry. The industry is often termed information technology while telecom and media make an apt part of this industry. This industry has impacted the major parts of the population, such as investors, market participants, traders, and investment bankers. If the telecom and media industry is looked at, it covers the networking, semiconductors, hardware, internet, mobile, and software industry. There are multiple firms and businesses working in the industry.

The increase can be seen by the presence of mergers, acquisitions, and public offerings. These industries are lacerating through agile and fast operations. However, these industries have created a huge gap. There are well-established businesses as well as start-ups looking for the innovation and expansion of intellectual property. This is essential for the success and expansion of this industry.

The Financial Reporting Standards

In terms of the information technology industry, the IAS 29 standard is the top one that defines financial instruments. According to this financial reporting standard, the businesses ought to recognize and measure the financial instruments inclusive of financial liabilities, selling and buying contracts for the non-financial entities, and financial assets. As per the standard, the initial recognition calls for the contractual provisions based on the entity becoming a party and to further explain the multiple classes; there are sub-standards as well. The sub-standards usually define the special rules that are applicable to the hedging instruments.

The sub-standards include;

IAS 18 – this substandard talks about the revenue and how the accounting conditions are defined for the recognition of the revenues given the sale and purchase of the services, goods, and shares. It clearly defines the service rendering, and the royalties and dividends are acquired. In other words, it outlines the fair value measurement of the revenues, and it is noteworthy to see that receivables need to be recognized when;

- If the item has some forecasted and predicted economic benefit adhered to it

- If the revenue and the amounts can be reliably measured

Mint Accountax

Every business starts its operation, given the unique innovation adhered to it. There are businesses that will make an entry into the market because they discovered efficient ways to deliver services or goods.

We understand the importance of technology and the impact of technology on businesses and how it is increasing the factor of competition among businesses. Businesses are using cutting-edge technology and innovation to give rise to new trends and competition. At Mint Accountax, we have a team of professional tax advisors and accountants in London who have honed the knowledge and skills to make financial reports, help with monthly bookkeeping, and other taxation service support. They have mastered detailed and in-depth knowledge about taxing principles and accounting procedures.

The biggest challenge in the information technology industry is access to funding to ensure sustained growth, success, and sustainability. The team of accountants has ample information regarding the challenges and has the capabilities to recommend the best practices that are evident to ensure success rate and that also define the tax reliefs to the companies. We ensure that your business is safe from government penalties regarding non-compliance with the regulations.

Our Services

If your business or company belongs to the information technology world, we are offering our well-shaped services. Through our services, we intend to;

- Provide assistance in complex accounting matters which can give rise to instrumental financial needs, revenue recognition, or the compensation

- Devise sturdy financial reporting tailored to meet your business requirements

- Help with the monthly bookkeeping services

- Help in VAT returns preparation

- Manage the business accounts for specific intervals (as requested by the business)

- Assist in the tax relief

- Assist in regulating the industry compliance

Customized Services

At Mint Accountax, we have helped multiple businesses which have rounded up the immense experience for us. Through this experience, we are able to tailor our services according to the client’ needs and the nature of their business.

Tax Reliefs

Through our services at Mint Accountax, we ensure that your business gets highest rewards and benefits from the government in the form of applicable tax reliefs.

Possible in Human Resource

Health Care Benefits

The great explorer of the truth the master builders human happiness.

Read moreSustainable Growth

Denounce with righteous indignation and dislike men who are beguiled and demoralized by the charms of pleasure.

Recruitment Process 48%

Employee Relations 79%

Compliance Audits 65%

Showing You

The Way of Success

Denounce with righteous indignation and dislike men who are so beguiled and demoralized by the charms of pleasure moment so blinded by desire that they cannot foresee the pain and trouble.

- Cost-Effective Services

- Helps Reduce Business Risks

- Management of Employee Performance

- Increasing Company’s Agility

Why Creote

Affordable & Flexible

Must explain too you how all this mistaken idea of denouncing pleasures praising pain was born and we will give you complete account of the system the actual teachings of the great explorer.

- Cost-Effective Services

- Helps Reduce Business Risks

- Management of Employee Performance

- Increasing Company’s Agility

Why Creote

Affordable & Flexible

Must explain too you how all this mistaken idea of denouncing pleasures praising pain was born and we will give you complete account of the system the actual teachings of the great explorer.

- Cost-Effective Services

- Helps Reduce Business Risks

- Management of Employee Performance

- Increasing Company’s Agility

Perfect for Small & Lare Brands

Bronze Package

Dormant Accounts

100

Preparation & Filing of Annual Accounts to Companies House

This package is for Companies that is dormant during the financial year.

Silver Package

Annual Accounts for Small Companies

350

Preparation & Filing of Annual Accounts to Companies House.

Preparation & Filing of CT600 to HMRC.

This Package is for Companies having turnover less than £50,000.

Gold Package

Annual Accounts for Large Companies

550

Preparation & Filing of Annual Accounts to Companies House.

Preparation & Filing of CT600 to HMRC.

This Package is for Companies having turnover less than £50,000.

Gold

Package

Pricing plan for startup company

949

Loves or pursues or desires obtain pain of itself is pain occasionally.

Business Partners

Denounce with righteous indignation and dislike men who are beguiled and demoralized by the charms of pleasure.

- Why is a partnership important?

-

Partnerships can increase your knowledge, expertise, resources, and opportunities to reach more people and make better products. These, along with 360-degree feedback, can propel your business to new heights. Your firm's ethos will be enhanced by a business partnership.

- How do you develop a partnership?

-

- Think about who you're currently working with, and why. One-off funding opportunities or personal connections can lead to many partnerships.

- Your approach should be developed

- Connect

- Keep in touch

- Work well

- What are the 7 elements of partnership?

-

Here are seven essential elements that should be included in formalized partnership agreements.

- Death. It is essential to provide support for the company in case of the death of a partner

- Disability

- Transfer of Partnership Interests

- Right of First Refusal

- Keyman Insurance.

- Financing.

- Valuation of Business Assets

- What are 5 things that should be included in a partnership agreement?

-

- Contributions to capital

- As partners, you will have to perform certain duties

- Assignment of profits and profits to others

- Acceptance of liability

- Dispute resolution

Docs

Docs  Support

Support